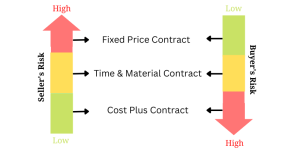

The PMBOK Guide (A Guide to Project Management Body of Knowledge) describes three basic types of contracts in procurement management. There is a cost risk associated with each contract type.

Cost Plus (CP) contracts are most risky for the buyers and Fixed Price (FP) contracts are most risky for the sellers.

Some books suggest that Time and Material (TM) contracts are most risky for the buyers but this is factually incorrect. The buyer has no control over cost or quantity in CP contracts and seller gets a chance bloat the costs. If CP contracts are not managed well, they can run into huge cost escalations or losses for the buyer.

Let us discuss in detail which type of procurement contract has highest risk for the buyer and which one poses greatest risk for the seller. While discussing, we will treat risk as a threat and not as an opportunity. We will also look at a chart that shows increasing order of risk for buyers and sellers.

Note: Although this article discusses risk in contract types from project management perspective but the concepts described in this article are applicable to both projects and operations management.

Types of Contract and Risk in Procurement

The cost risk of buyers and sellers varies with the contract type. Buyers assume highest risk in CP contracts whereas sellers assume greatest risk in FP contracts.

Contract Types and Sub-types

The PMBOK Guide describes following contract types and their sub-types:

-

- Fixed Price Contract

- Cost Plus Contract or Cost Reimbursable Contract

- Cost Plus Fixed Fee (CPFF)

- Cost Plus Percentage Fee (CPPF)

- Cost Plus Incentive Fee (CPIF)

- Cost Plus Award Fee (CPAF)

- Time and Material Contract or Unit Price Contract

You can look at my article on different kinds of project management contracts to understand the nature and scope of above types.

Note: You might find different nomenclature in PMP reference books and non-PMI (Project Management Institute) reference material but for the sake of standardization, I have used PMBOK Guide’s terminology.

What is Project Risk?

A risk in project management simply means uncertainty i.e. it may or may not occur. A risk is said to be high if uncertainty (probability of occurrence) is high. On the other hand a risk is said to be low if uncertainty is low. Simply speaking higher the uncertainty, higher the risk.

A risk that is high for the buyer will be low for the seller and vice versa.

Who Takes More Risk for Each Contract Type – Buyer or Seller?

Let us find out who would have least/maximum Cost Risk in different Types of Contracts. Following diagram will give you an overall picture.

In the above diagram the direction of arrows signifies increase in Risk. Let us discuss different Types of Contracts in the context of above diagram.

1. FP Contracts

At the start of the Contract, the Buyer knows how much payment has to be made to the Seller. Buyer liability is Fixed. Hence, we can say that the Buyer has very low Cost Uncertainty.

At the start of the Contract, the Seller does not about about the quantum of profit. The Seller may lose money. The Seller makes Profit if work is completed within the funds provided by the Buyer. Otherwise the Seller makes a loss. Hence, we can say that the Seller has high Uncertainty for making Profit.

Risk is low for the Buyer while it is high for the Seller.

2. CP Contracts

At the start of the Contract, the Buyer does not know how much payment will be made to the Seller. Buyer has potentially unlimited liability in a pure CP Contract. Hence, we can say that the Buyer has a very high Cost Uncertainty.

At the start of the Contract, the Seller knows that the Buyer will reimburse all legitimate costs. In addition the Seller will also get agreed Fees. The Seller likely to make always make some profit in a pure CP Contracts. Hence, we can say that the Seller has a low Uncertainty for making Profit.

Risk is low for the Seller while it is high for the Buyer.

3. T&M Contracts

T&M is middling Type of Contract. It is hybrid of FP and CP. T&M Type of Contracts are based on a Fixed Rate. This Fixed rate is applicable for both the Buyer and the Seller. The Buyer and the Seller share the uncertainty in T&M Contracts.

At the start of the Contract, the Buyer does not know for how long will the Contract run or how much material/resources will be required to complete the Contract. The Buyer’s cost might escalate due to these unknowns. Hence, we can say that the Buyer has some degree of Cost Uncertainty.

At the start of the Contract, the Seller does not know how the Cost of labor or material will vary over the life-cycle of the Contract. The Cost of labor or material may increase over the life-cycle of the Contract. This might decrease the profit per unit of the Seller. The Seller may even lose money if the Costs goes up substantially. Hence, we can say that the Seller has some degree of Cost Uncertainty.

Both the Buyer and the Seller share the Risk.

Questions on Contract Type Risk in PMP Exam

If you are a PMP (Project Management Professional) aspirant then you must understand how to combine procurement contracts and risk. You might get 1-2 such questions related to this concept in the PMP exam.

All risks entail impact at least one of the project objectives, which include objectives related to time, scope, quality, or cost. Usually PMP questions do not mention anything about the nature of impact. The question just asks “Which Type of contract is more risky?”.

If the PMP question does not mention anything about the nature of impact, you should assume that the question is asking about the cost risk i.e. who among the buyer or seller takes on more cost risk.

Let’s look at the following question.

You are working for a Defense Contractor. Your company is bidding for a Government’s secret project called Project “Hush-Hush”. The Government has decided to outsource this project as a Fixed Price Contract. Who has more risk for this project?

- Defense Contractor

- Government

- All projects are risky. Both Defense Contractor and Government have equal risk.

- It is a secret project. Since the information provided is insufficient, it cannot be determined who has more risk.

A typical PMP question like this would present a project or procurement scenario with some details about the project or contract. The question would then ask who has more Risk in the given situation – the Buyer or the Seller. To answer such questions, all you have to do is understand which type of contract is being described in the situation and identify if the question is asking about the risk for the buyer or seller.

Answer: Since it is a FP contract, Defense Contractor has higher risk. Option ‘a’ is the correct answer.

Can you find out who would bear more/less risk for each of the sub-types?

Please leave a comment below.

Great. Thanks for posting

As first head PMP 3ed the buyer take the most risk by T&M contracting.

best regards

Thanks Ziad. I am aware that Head FIrst PMP says T&M is most risky for the buyers. But the book does not explain why it treats T&M as most risky. I have written the reason/explanation in my post. I think he book is written in a slightly casual language and it is not completely conformant with PMBOK Guide. Other books like Rita Mulcahy treat T&M as a medium risk for the buyer and CP as high risk.

You can also read my complete review of Head First PMP and its comparison with other books.

BR

Praveen.

I need to know which sub types within the Cost Plus type is more risky for the buyer ?